Understanding Your Rights After a Lyft Car Accident

A Lyft crash can turn your world upside down in seconds. Whether you’re a passenger, driver, or another motorist involved in a collision with a rideshare vehicle, you’re suddenly facing a maze of insurance policies, legal questions, and mounting bills.

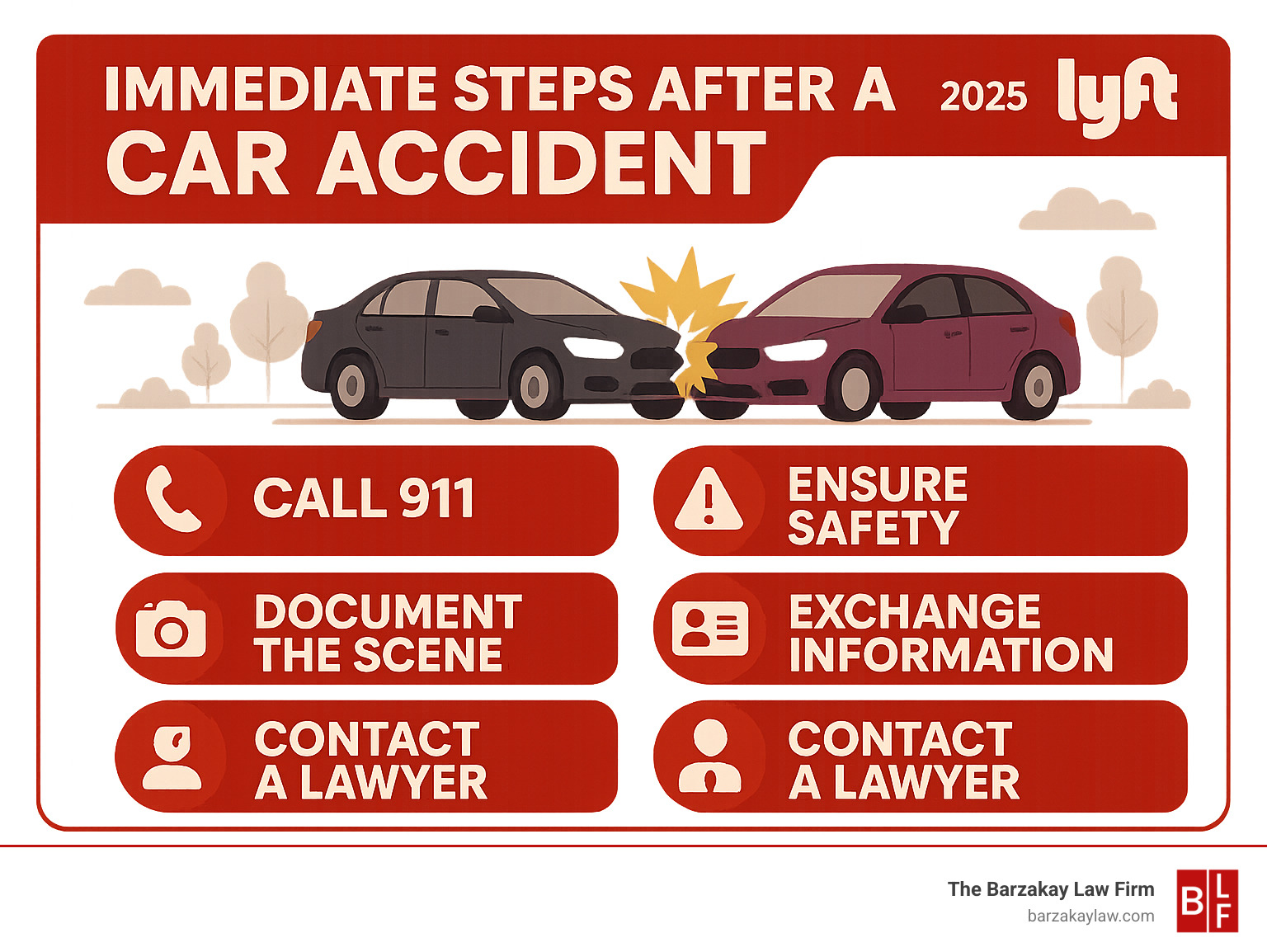

Quick Steps After a Lyft Accident:

- Call 911 – Get medical help and police on scene

- Document everything – Photos, witness info, driver details

- Report to Lyft – Use the app or call their support line

- Seek medical care – Even if you feel fine initially

- Contact a lawyer – Before talking to insurance adjusters

The rise of rideshare services has fundamentally changed accident claims. Research shows that ridesharing services have boosted traffic fatalities by 2-3% since 2011, with thousands of people hurt in Uber and Lyft crashes each year.

Here’s the challenge: Lyft’s insurance coverage isn’t simple. It changes based on whether the driver’s app was on, if they had accepted a ride, or if passengers were in the car. That creates confusion about which insurance company pays for your medical bills, lost wages, and pain and suffering.

If you’ve been injured in a Lyft accident in South Florida — whether in Miami, Hollywood, or Boca Raton — you need to understand your rights before the insurance companies start calling.

This guide walks you through every step, from the moment of impact to filing your claim and seeking fair compensation. We’ll break down Lyft’s complex insurance system, explain when you can sue the company directly, and show you how to protect your family’s financial future.

First Steps to Take Immediately After a Collision

The moments right after a Lyft accident can feel overwhelming, but staying calm and taking the right steps will protect both your health and your legal rights. Whether you’re a passenger heading home from Miami Beach, a Lyft driver picking up a fare in Hollywood, or another driver who collided with a rideshare vehicle, what you do next matters enormously.

Your safety comes first, always. Take a deep breath and quickly assess if anyone is hurt. If you or anyone else has serious injuries, call 911 immediately — don’t second-guess yourself. Even if you feel okay right now, that doesn’t mean you’re injury-free. Adrenaline is powerful stuff, and it can mask pain from whiplash, concussions, or internal injuries for hours.

Seek medical attention as soon as possible, even for what seems like minor discomfort. This isn’t just about your health (though that’s most important) — it creates a medical record that directly links your injuries to the accident. Insurance companies love to argue that injuries happened somewhere else if there’s any gap in treatment. Don’t give them that opening.

If it’s safe to move your car, get it out of traffic and turn on your hazard lights. South Florida roads are busy enough without adding a crash scene to the mix.

Now comes the information exchange. Get the Lyft driver’s personal insurance details along with their name, phone number, and license plate. If another driver caused the accident, you’ll need their information too. Don’t forget about passengers — they might be witnesses or have their own claims.

Call the police and request a report. Some officers won’t respond to minor accidents, but having an official police report gives you an unbiased account of what happened. In Boca Raton and other South Florida cities, you can often file a report online if police don’t come to the scene.

Look around for witnesses who saw the crash happen. These neutral observers can be incredibly valuable if there’s a dispute about who was at fault. Get their names and phone numbers — you’ll be grateful later if their testimony supports your version of events.

You can find a comprehensive step-by-step guide for handling any car accident, but rideshare crashes have their own unique complications that we’ll walk you through.

Documenting the Scene of Your Lyft Car Accident

Your smartphone is about to become your most important tool for building a strong Lyft accident claim. The photos and screenshots you take right now could make the difference between a fair settlement and a fight with the insurance company.

Take photos of everything — and we mean everything. Snap pictures of all vehicle damage from multiple angles, including close-ups of dents, scratches, and broken parts. Step back and get wide shots showing how the cars ended up positioned on the road. If you have visible cuts, bruises, or other injuries, photograph those too.

Here’s something many people forget: screenshot your Lyft app immediately. Your ride details, the driver’s information, your pickup and destination, and the route all prove you were an active passenger when the crash happened. This simple screenshot can save you months of headaches with insurance companies who might try to claim you weren’t actually on a Lyft trip.

Document the accident scene itself by photographing road conditions, weather, traffic signals, stop signs, and any skid marks or debris. If it’s raining in Fort Lauderdale or there’s construction in downtown Miami, get pictures of those conditions. They might explain how the accident happened and who’s really at fault.

Don’t forget to capture street signs or landmarks that clearly show the location. Insurance adjusters and lawyers often visit accident scenes later, but conditions change. Your photos preserve the scene exactly as it was when the crash occurred.

The reality is that leveraging technology in car accident claims has become crucial for getting fair compensation. The more thorough your documentation, the stronger your case will be.

Insurance companies have teams of investigators and adjusters working to minimize what they pay out. Your photos and screenshots level the playing field by giving you solid evidence of what really happened. Take the time to be thorough now — your future self will thank you.

Understanding Lyft’s Complex Insurance Coverage

Navigating the insurance maze after a Lyft crash can feel overwhelming. Unlike a typical fender-bender where you’re dealing with two personal auto insurance policies, rideshare collisions involve multiple layers of coverage that can shift depending on what the driver was doing when the accident happened.

Here’s what makes it tricky: Lyft’s insurance coverage isn’t a one-size-fits-all situation. It changes based on whether the driver had their app turned on, if they’d accepted a ride request, or if passengers were in the car. Think of it like a traffic light — different phases mean different rules apply.

Most personal auto insurance policies have a big exclusion: they don’t cover drivers when they’re using their car for commercial purposes like ridesharing. This means if your Lyft driver didn’t tell their insurance company about their side gig or didn’t buy a rideshare endorsement, their personal policy might deny the claim entirely.

Here in Florida, we have no-fault insurance laws. This means your Personal Injury Protection (PIP) coverage typically kicks in first to pay your initial medical expenses — up to $10,000 — regardless of who caused the accident. But when your injuries are serious or your damages exceed those PIP limits, understanding exactly which Lyft insurance applies becomes crucial for getting the compensation you deserve.

If you’re dealing with the aftermath of a crash in Boca Raton or anywhere in South Florida, knowing these insurance phases can make the difference between a quick settlement and a long, frustrating battle. You can learn more about Understanding No-Fault Insurance After Boca Raton Car Crash to better understand how Florida’s system works.

The good news? Lyft provides detailed Insurance resources for Lyft drivers that explain their coverage. We’ve broken it down for you in simple terms below.

Comparing Lyft’s Insurance Coverage by Driver Status

Understanding these three phases is absolutely critical after a rideshare collision — they determine how much insurance coverage is available and who pays your bills.

Phase 1 happens when the driver’s app is completely off. At this point, they’re just a regular driver, and only their personal auto insurance applies. If they haven’t disclosed their rideshare activities to their insurer, you could be looking at a denied claim and limited options.

Phase 2 begins the moment the driver turns on their Lyft app and is waiting for ride requests. During this period, Lyft provides what’s called “contingent liability coverage” — it only kicks in if the driver’s personal insurance won’t cover the accident. The limits here are modest: $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $25,000 for property damage. These amounts can disappear quickly if you’re seriously injured in a crash on busy Miami streets.

Phase 3 offers the most robust protection. Once the driver accepts a ride request and is either heading to pick you up or actively driving you to your destination, Lyft’s primary commercial insurance takes over. This provides Up to $1 million in coverage for liability claims, plus uninsured and underinsured motorist protection.

The timing matters enormously. If you’re injured while the driver is in Phase 2 versus Phase 3, you could be looking at vastly different compensation amounts. This is why documenting exactly what was happening when your accident occurred — including those app screenshots we mentioned earlier — can be so important for your case.

| Driver Status / Phase | Insurance Coverage Applies |

|---|---|

| Phase 1: App is Off | Driver’s personal insurance applies. If they haven’t told their insurer about rideshare driving, coverage may be denied entirely. |

| Phase 2: App is On, Waiting for a Request | Lyft’s contingent liability coverage kicks in if personal insurance won’t cover it. Limited to $50,000 per person bodily injury, $100,000 per accident bodily injury, and $25,000 per accident property damage. |

| Phase 3: En Route to Pick Up or During a Ride | Lyft’s primary liability insurance provides up to $1 million in coverage, plus Uninsured/Underinsured Motorist (UM/UIM) coverage for serious accidents. |