Understanding Lyft Car Accident Settlements in South Florida

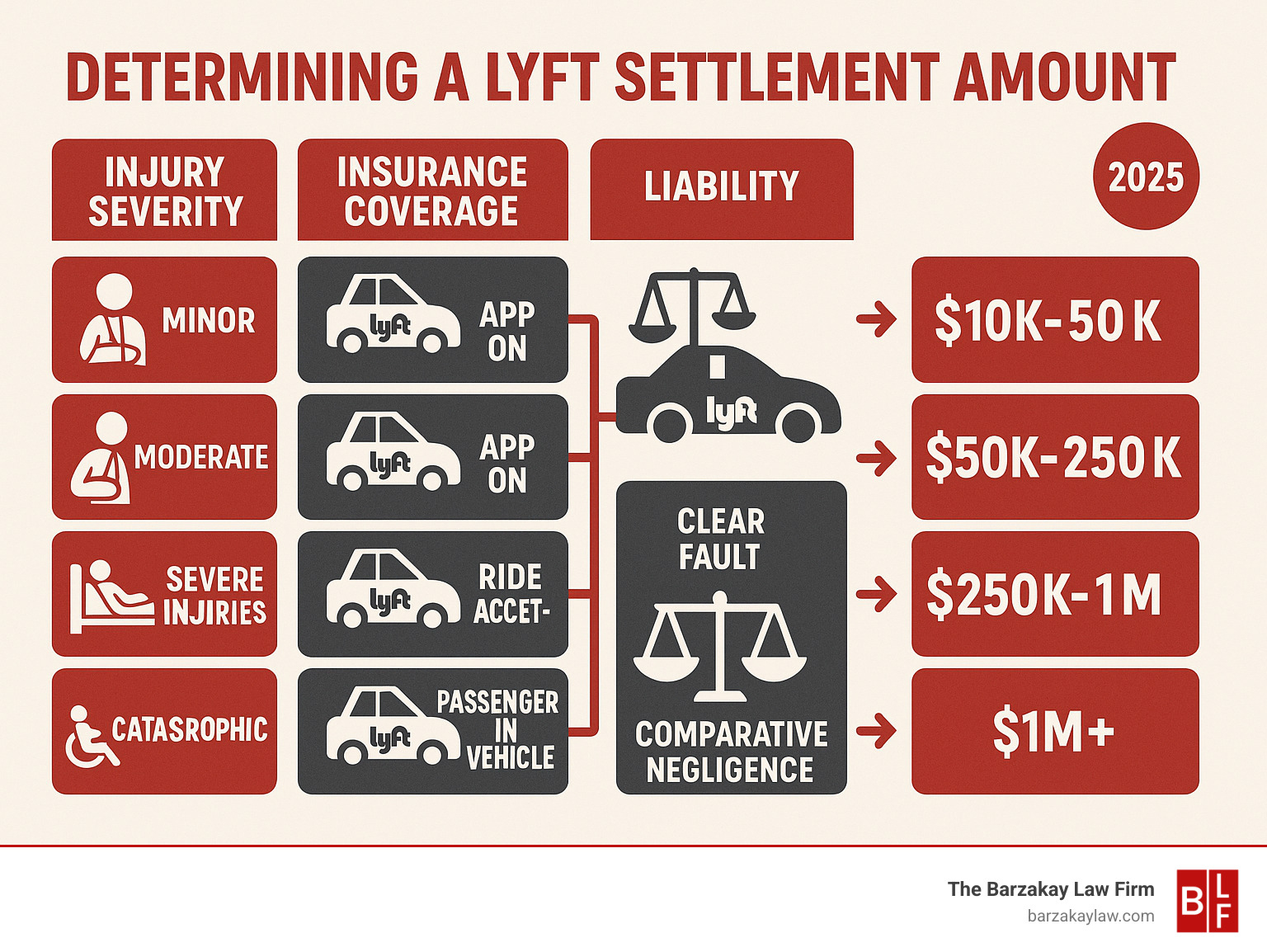

A lyft car accident settlement can range from thousands to over a million dollars. Your potential compensation depends on several factors.

Settlement Value Factors:

- Minor injuries: $10,000 – $50,000 (whiplash, bruises)

- Moderate injuries: $50,000 – $250,000 (fractures, concussions)

- Severe injuries: $250,000 – $1 million+ (traumatic brain injury, spinal cord damage)

- Wrongful death: Often six to seven figures

Key Variables That Affect Your Settlement:

- Severity and permanence of injuries

- Applicable insurance coverage

- Clear liability vs. shared fault

- Medical expenses and lost wages

- Pain and suffering

If you’re injured in a Lyft accident in South Florida, understanding how settlements work is crucial for your financial recovery.

Rideshare cases are different from traditional car accidents. Lyft cases involve multiple insurance layers based on the driver’s app status, meaning similar accidents can have very different settlement outcomes.

Research shows Lyft passenger accident settlements can range from $300,000 to $1 million, especially in cases requiring surgery. However, these figures depend on proving liability and navigating the complex insurance process.

For families facing serious injuries or wrongful death, the financial stakes are high. Medical bills, lost wages, and long-term care costs can be devastating.

Lyft car accident settlement terms to learn:

What is a Lyft Accident Settlement and What’s it Worth?

A Lyft car accident settlement is financial compensation from insurance companies to cover your medical bills, pain, and other losses after a crash. Unlike regular car accidents, Lyft cases are complex because drivers are independent contractors. This creates a web of insurance coverage, involving either the driver’s personal policy or Lyft’s large commercial policy.

With more rideshare vehicles on South Florida roads, understanding your rights is essential. Research even shows the arrival of Uber and Lyft has led to a 3% increase in car accident fatalities overall.

What Factors Influence a Lyft Car Accident Settlement?

Your Lyft car accident settlement depends on several key factors that insurance companies scrutinize.

Your injury severity is the core of your settlement. A minor strain is valued differently than a life-altering traumatic brain injury. Insurance adjusters will scrutinize your medical records.

Medical expenses form the foundation of your economic damages. This covers all medical costs, from the ambulance ride to future needs like surgery or long-term therapy.

Lost wages and earning capacity are critical. If your injuries prevent you from working, that lost income and any reduction in future earning ability are key parts of your claim.

Property damage covers repairs to your car, damaged personal items, rental car costs, and your vehicle’s diminished value.

Pain and suffering compensates for the non-financial impact, like physical pain, anxiety, and loss of enjoyment in life. It’s often a significant part of a settlement.

Liability and fault can make or break your case. Florida’s modified comparative fault rule reduces your settlement by your percentage of fault. If you are more than 50% at fault, you cannot recover damages.

Average Settlement Amounts: A Guideline, Not a Guarantee

These average settlement ranges are a guideline, not a guarantee, as every Lyft car accident settlement is unique.

Minor injuries like whiplash or bruises typically settle between $10,000 and $50,000. These cases usually involve injuries that heal relatively quickly.

Moderate injuries involving fractures or concussions often result in settlements from $50,000 to $250,000, usually requiring more extensive medical treatment.

Severe injuries like traumatic brain injuries or spinal cord damage frequently lead to settlements from $250,000 to over $1 million. Cases requiring surgery often exceed $250,000.

Wrongful death claims often reach six or seven figures, depending on factors like the victim’s age and earning potential.

For South Florida families, a serious accident can be financially devastating. These ranges help you gauge if an insurance offer is fair or an attempt to underpay your claim.

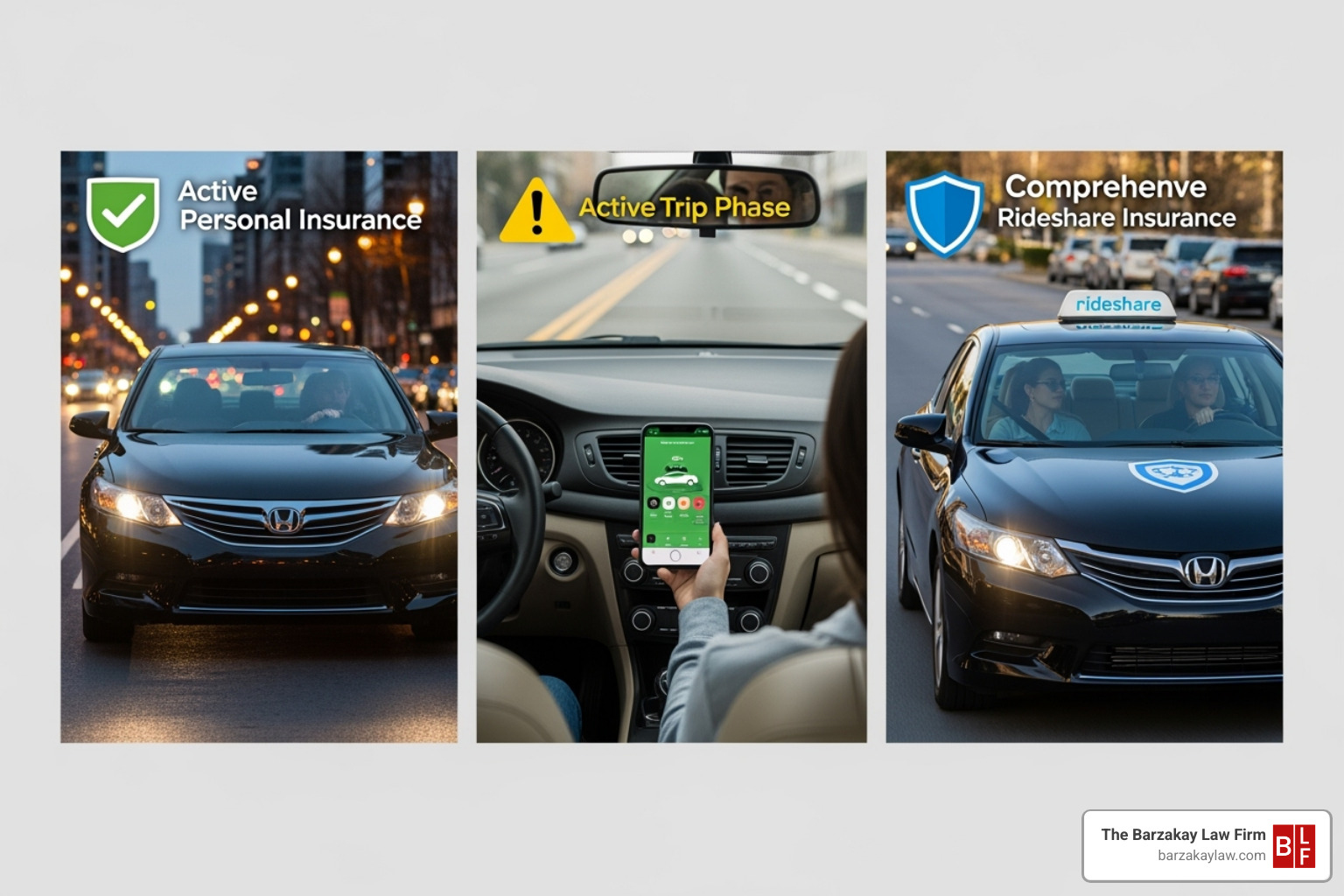

How Lyft’s Insurance Coverage Works: The Three Critical Phases

Navigating Lyft’s complex insurance is a confusing part of a Lyft car accident settlement claim. Unlike typical accidents, Lyft’s coverage changes based on the driver’s status at the time of the crash, which can be broken down into three critical phases.

As independent contractors, Lyft drivers have a unique insurance setup. Their personal auto insurance covers personal driving. Once they log into the Lyft app, Lyft’s commercial policies apply in layers depending on their activity. This affects your Lyft car accident settlement potential in Hollywood, Boca Raton, and throughout South Florida:

| Driver Status | Applicable Insurance | Coverage Limits (Typical) |

|---|---|---|

| Period 0: App is Off | Driver’s Personal Auto Insurance | Varies by personal policy |

| Period 1: App is On, Waiting for Request | Lyft’s Contingent Liability | $50k/person, $100k/accident (bodily injury); $25k/accident (property) |

| Period 2 & 3: En Route to Passenger / During Ride | Lyft’s Primary Commercial Policy | $1 Million Third-Party Liability; Uninsured/Underinsured Motorist |

Period 0 is when the driver’s app is off. The driver is covered by their personal auto insurance, and an accident is treated as a standard car accident claim.

Period 1 begins when the driver turns on the app to wait for a request. In this phase, Lyft’s contingent liability coverage applies if the driver’s personal insurance denies the claim or is insufficient. It provides up to $50,000 per person/$100,000 per accident for bodily injury and $25,000 for property damage.

Periods 2 and 3 are when the driver accepts a request or has a passenger. Lyft’s $1 million primary commercial policy applies, including third-party liability and uninsured/underinsured motorist coverage.

Knowing the applicable period is crucial as it determines the available insurance money for your settlement. For more details, you can review Lyft’s insurance coverage for drivers.

What Happens if the At-Fault Driver is Uninsured?

If an uninsured driver hits you during a Lyft ride, you have options. During Periods 2 and 3, Lyft’s $1 million policy includes uninsured and underinsured motorist (UM/UIM) coverage. This protects you if the at-fault driver has no insurance or not enough to cover your damages.

Hit-and-run accidents are treated similarly, as the fleeing driver is effectively uninsured. If this happens during your ride, the same UM protections apply.

In Period 1, the situation is more complex. The driver’s personal insurance is primary, and you may need to rely on your own UM coverage if theirs is inadequate. For more on hit-and-run cases, see Lyft Hit and Run claims and your legal options.

Calculating Your Potential Compensation: Types of Damages

Understanding the types of compensation you can recover is crucial for your Lyft car accident settlement. Damages fall into categories that address the different ways the accident has affected your life. The law recognizes both financial losses (economic damages) and non-financial losses (non-economic damages).

Economic Damages: Your Financial Losses

Economic damages are the tangible, calculable financial losses from your accident, supported by bills and receipts.

Medical expenses form the backbone of most claims. This covers all past and future medical costs, including ambulance rides, hospital stays, surgery, medication, and physical therapy.

Lost wages and earning capacity includes income lost while you recover and compensation for any long-term reduction in your ability to earn a living due to your injuries.

Property damage covers the cost to repair or replace your vehicle and any personal property damaged in the crash, like a phone or laptop.

Rehabilitation and adaptive costs are crucial in severe cases and may include specialized equipment or home modifications.

Non-Economic Damages: The Human Cost

Non-economic damages compensate for intangible losses that are harder to quantify but are a real and significant part of your suffering.

Pain and suffering covers the physical pain and discomfort from your injuries, both immediate and chronic. Its value is often calculated based on the severity of your economic damages and other factors.

Emotional distress compensates for psychological impacts like anxiety, depression, and PTSD caused by the accident.

Loss of enjoyment of life is for when your injuries prevent you from enjoying hobbies, activities, or daily life as you did before.

Loss of consortium applies when a severe injury negatively impacts your relationship with your spouse, compensating for the loss of companionship and support.

Permanent disability or disfigurement carries long-term consequences, such as visible scarring or loss of mobility.

In rare cases involving reckless behavior, punitive damages may be awarded to punish the wrongdoer.

Protecting Your Claim: Steps to Take After a Lyft Accident

What you do immediately after a Lyft accident can significantly impact your Lyft car accident settlement claim. You must act quickly to protect your interests, as insurance companies will be protecting theirs.

Knowing what to do and what to avoid can mean the difference between a fair settlement and a frustrating battle with insurers. For families dealing with rideshare accidents, connecting with a Miami Rideshare Accident Lawyer early can help protect your rights.

What to Do Immediately After the Crash

Your first priority is safety, but documenting the scene is a close second.

- Call 911 and seek medical attention. Adrenaline can mask serious injuries. Seeking immediate medical attention creates an official record linking your injuries to the crash, which is crucial for your claim.

- Report the accident in the Lyft app. This is essential to start their claims process and access their insurance coverage.

- Document everything with photos and videos. Use your phone to take pictures of vehicle damage, the scene, road conditions, and visible injuries. Capture license plates and the Lyft driver’s identification.

- Exchange information with everyone involved. Get names, contact info, insurance details, and license plate numbers from all drivers.

- Get witness contact details. Their testimony can be vital if liability is disputed.

How Long Does the Lyft Car Accident Settlement Process Take?

The timeline for a Lyft car accident settlement varies. Minor cases may resolve in months, while complex cases can take a year or more. The process involves claim filing, investigation, and negotiation.

A settlement negotiation usually begins only after you reach “maximum medical improvement” (MMI), when your long-term medical prognosis is clear. If negotiations fail, filing a lawsuit (litigation) may be necessary. Remember Florida’s statute of limitations: you generally have two years from the accident date to file a lawsuit, or you lose your right to compensation.

Common Challenges and Insurance Company Tactics

Insurance companies aim to pay as little as possible. Knowing their tactics helps protect your Lyft car accident settlement.

- Disputing liability: They may blame you or others to reduce their payout under Florida’s comparative fault rule. Scene evidence is crucial to counter this.

- Lowball settlement offers: They often make quick, low offers, hoping you’ll accept before you know the full extent of your damages.

- Delaying tactics: They may use delays—like repeated document requests or slow responses—to pressure you into accepting a lower settlement.

- Minimizing your injuries: They may claim your injuries aren’t severe or are pre-existing. Consistent medical treatment and documentation are your strongest defense.

- Requesting recorded statements: Avoid giving a recorded statement to an insurer without legal advice. They can use your words against you.

For those dealing with the complexities of rideshare accidents, understanding these challenges is just the beginning. Learn more about how Vehicle Accident Lawyers Rideshare Accidents can protect your interests throughout this process.

Frequently Asked Questions about Lyft Accident Claims

After a Lyft accident, families in South Florida often have the same questions about their injuries, bills, and future. Here are answers to the most common concerns.

Can I still get a settlement if I was partially at fault for the accident in Florida?

Yes, you can still recover compensation if you were partially at fault. Florida uses a modified comparative negligence system. Under this rule, your settlement is reduced by your percentage of fault. For example, if you were 30% at fault for an accident with $100,000 in damages, you could recover $70,000.

However, Florida’s 51% bar rule prevents you from recovering any damages if you are found to be more than 50% at fault. This makes fault determination critical to your case.

What are my rights as a Lyft driver if I’m in an accident?

As a Lyft driver, your rights after an accident depend on your status at the time of the crash and who was at fault.

First, because you are an independent contractor, workers’ compensation does not apply. For vehicle damage, Lyft offers contingent collision coverage up to your car’s value, but it comes with a high deductible (typically $2,500) and only applies if your personal policy doesn’t cover the damage.

If another driver causes your injuries while you are en route to a passenger or during a ride (Phase 2 or 3), you may be covered by Lyft’s $1 million uninsured/underinsured motorist policy. These situations can be complex. You can learn more about how we approach these cases with Vehicle Accident Lawyers Rideshare Accidents.

Can I sue Lyft directly for an accident?

Suing Lyft directly is challenging, but not impossible. Lyft classifies its drivers as independent contractors to limit its direct liability.

Usually, it’s more effective to seek compensation from the at-fault driver’s insurance or Lyft’s commercial insurance, which provides up to $1 million in coverage for active rides.

Direct lawsuits against Lyft may be possible in cases of negligent hiring (e.g., they failed to screen a dangerous driver) or if their app technology contributed to the crash. These claims require significant evidence to prove. What matters most for your Lyft car accident settlement is identifying all available sources of compensation and pursuing them strategically.

Get Guidance on Your Lyft Accident Claim

A Lyft accident can be overwhelming, leaving you with injuries, medical bills, and lost income. Navigating the insurance process that follows is often confusing and stressful.

You don’t have to steer this alone.

At The Barzakay Law Firm, we help families across South Florida, including Hollywood, Miami, and Boca Raton, with these exact situations. We understand the pressure from insurance adjusters and their lowball offers. Securing a fair Lyft car accident settlement means navigating complex insurance and countering tactics from large companies. We can help build a strong case that tells your story.

We work on a contingency fee basis, so you pay nothing upfront. We only get paid if we win your case, which means our success is tied to yours. Our approach is to handle every aspect of your claim: gathering evidence, communicating with insurers, and fighting back against their tactics. We prepare every case as if it will go to court to ensure you are in the strongest position to negotiate.

Our goal is to maximize your compensation to cover all your losses—medical, financial, and emotional—so your family can rebuild without financial stress.

If you or someone you love has been injured in a Lyft accident anywhere in South Florida, don’t wait for the insurance companies to “do the right thing.” They won’t. But we will fight to make sure they do. Learn more about our approach to rideshare accidents and how we can help you by visiting our dedicated page on rideshare accidents in Hollywood.

Contact us today for a free consultation. Let’s talk about your case and map out the right path forward for your family.