Understanding the Risks of Rideshare Travel

Rideshare car accident cases are more common than many people realize. As services like Uber and Lyft became essential transportation in South Florida—from Miami to Hollywood to Boca Raton—the number of crashes involving these vehicles has grown.

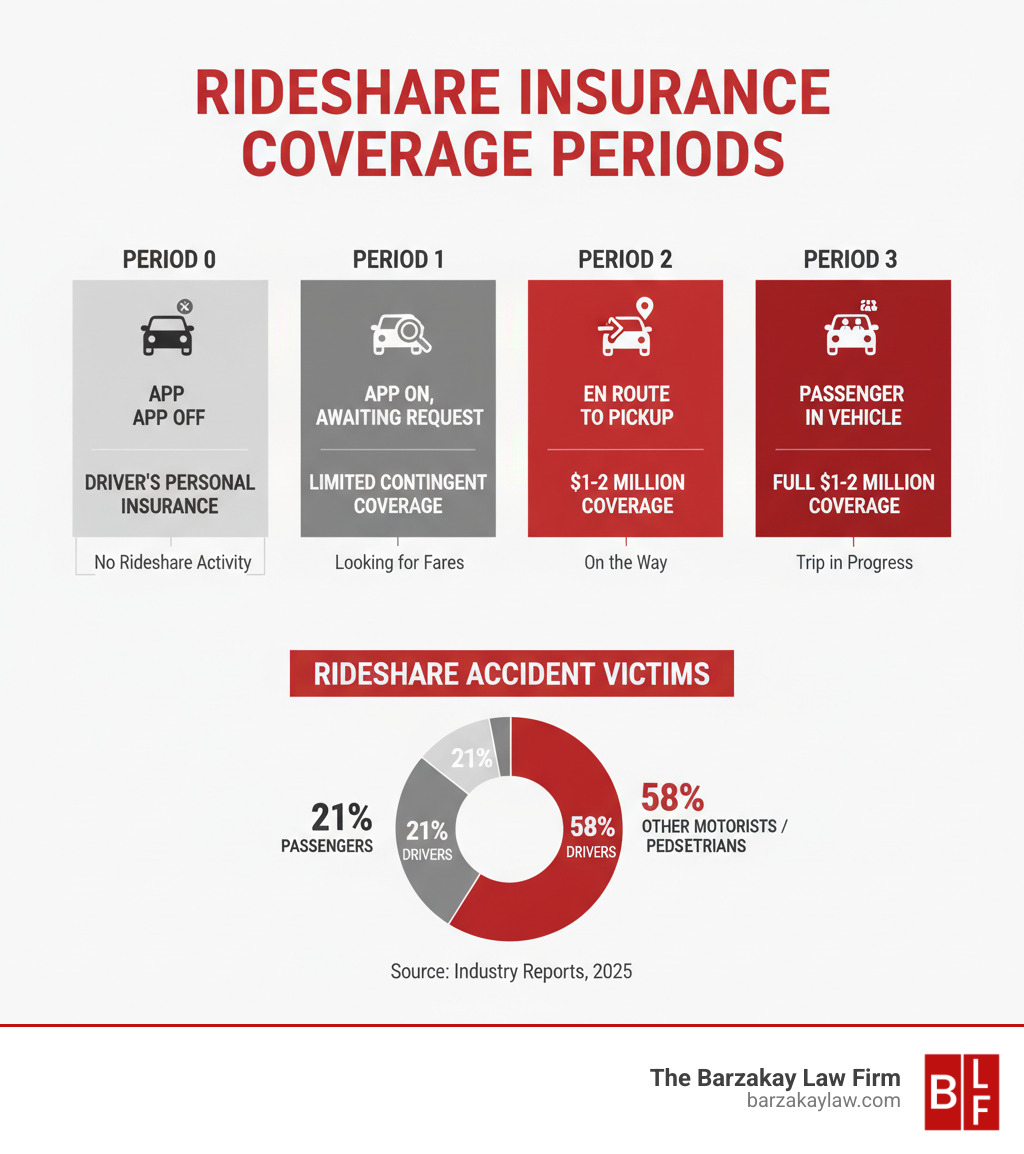

Quick Facts About Rideshare Accidents:

- Nearly 1,000 additional traffic deaths occur daily across the country due to increased rideshare vehicles on the road

- Between 2017 and 2018, Uber alone recorded 97 fatal crashes resulting in 107 deaths

- 58% of rideshare crash victims were other motorists or pedestrians—not passengers or drivers

- Over 80,000 rideshare licenses were issued in Toronto alone as of December 2024, reflecting the industry’s explosive growth

The convenience of summoning a ride with a smartphone has transformed travel, but it comes with hidden risks. When a rideshare accident happens, victims face unique challenges that don’t exist in regular car crashes.

Insurance coverage depends on the driver’s app status, and liability can involve the driver, the rideshare company, or another motorist. The claims process is far more complex than a standard auto accident.

If you’ve been injured in a rideshare accident in South Florida, understanding your rights is the first step. While dealing with medical bills, lost wages, and pain can be overwhelming, you don’t have to steer this alone.

Rideshare car accident terms to remember:

What to Do Immediately After a Rideshare Accident

The moments after a rideshare car accident are chaotic. The actions you take can significantly impact your physical and financial recovery. Let’s walk through the essential steps.

Prioritize safety. Check yourself and others for injuries. If you can, move safely away from traffic. It is important to get a medical evaluation even if you feel fine, as adrenaline can mask serious injuries that may appear hours or days later.

Call 911 immediately, especially if anyone is hurt or there is significant vehicle damage. A police report creates an official record of the incident, which is invaluable when dealing with insurance companies. Do not leave the scene before the police arrive.

Florida’s no-fault insurance system means you’ll typically file initial medical expense claims through your own Personal Injury Protection (PIP) insurance. Crucially, do not delay medical treatment. Insurance companies often argue that if you didn’t seek immediate care, your injuries must not have been serious.

Immediate Steps to Take After a Rideshare Car Accident

Gather evidence at the scene. Use your smartphone to take photos and videos of the damage to all vehicles, their positions, road conditions, traffic signs, and any visible injuries. The more you document, the stronger your case.

Find witnesses. If bystanders saw what happened, ask for their names and contact information. Independent accounts can be incredibly valuable.

Get driver details. Exchange names, phone numbers, driver’s license numbers, license plates, and insurance information with everyone involved, including your rideshare driver. Do not discuss who was at fault or apologize. Even a simple “I’m sorry” can be used against you.

Screenshot the rideshare app. If you were a passenger, capture the screen showing the driver’s status—whether they were on a trip, en route, or available. This detail is critical, as the applicable insurance coverage for your rideshare car accident depends on it.

Report the accident to the rideshare company. You can do this through the app. For Uber, use the Safety Toolkit to “Report a crash” or speak with support staff. Report the crash to Uber for more guidance. For Lyft, you can report through their app or website. Be honest, but avoid making statements that could be seen as admitting fault.

Contact your own insurance provider. Notify your personal auto insurance company, even if you weren’t at fault. They can explain your PIP coverage and guide you on the initial steps.

Taking these steps provides a strong foundation for your claim. Whether you’re in Miami, Hollywood, or Boca Raton, these actions are vital. You don’t have to figure out the complicated insurance and legal parts on your own.

Understanding Insurance and Liability in a Rideshare Car Accident

Figuring out insurance coverage after a rideshare car accident is complex. Unlike typical crashes, these incidents can involve multiple insurance policies and confusing liability questions. This is because rideshare drivers are independent contractors, not employees. This distinction means Uber and Lyft are not automatically responsible for their drivers’ actions.

Instead, a patchwork of insurance coverage applies, depending on the driver’s app status at the moment of the crash. Insurance companies use this complexity to their advantage. That’s why having a Miami Rideshare Accident Lawyer who understands these nuances can make a significant difference.

The Four Periods of Rideshare Insurance Coverage

Insurance coverage changes based on the driver’s app status, falling into four distinct phases.

Period 0: The driver is not logged into the rideshare app. If an accident occurs, only the driver’s personal auto insurance applies. Uber and Lyft’s policies are not in effect.

Period 1: The driver is logged in and waiting for a ride request. During this “waiting period,” rideshare companies provide contingent liability coverage. In Florida, this is typically $50,000 per person and $100,000 per accident for bodily injury, plus $25,000 for property damage. This coverage may only apply if the driver’s personal insurance denies the claim.

Period 2: The driver has accepted a ride and is en route to pick up the passenger. At this point, a substantial commercial insurance policy kicks in. Both Uber and Lyft provide $1 million in third-party liability coverage, along with uninsured/underinsured motorist coverage. You can learn more about Uber’s insurance policy details on their site.

Period 3: This period covers the entire trip, from the moment the passenger enters the vehicle until they are dropped off. The same robust $1 million commercial liability coverage from Period 2 remains in effect.

Determining which company’s insurance applies can be a legal headache, especially if a driver in a busy area like Miami has multiple rideshare apps open at once.

Who Is Covered? Passengers, Pedestrians, and Other Motorists

A rideshare car accident affects more than just the people in the cars. Our research shows that 58% of victims are other motorists or pedestrians.

If you were a passenger in an Uber or Lyft, you are not at fault. Your injuries should be covered by the rideshare company’s $1 million commercial policy. In Florida, you will first file for immediate medical costs through your own Personal Injury Protection (PIP) insurance. For more details, see our Lyft Car Accident Complete Guide.

For pedestrians and cyclists hit by a rideshare vehicle, coverage depends entirely on the driver’s app status. Proving this status often requires legal action to obtain records from the rideshare company.

For other motorists, liability depends on who was at fault. If the rideshare driver was at fault and logged into the app (Periods 1-3), the company’s policy should cover your damages. If the driver was off-app, you’ll deal with their personal insurance. If you were at fault, your own insurance is responsible.

Uninsured and underinsured motorist (UM/UIM) coverage is a critical safety net. This protection is essential if the at-fault driver lacks sufficient insurance. In Florida, Lyft provides UM/UIM coverage up to $1,000,000 when a driver is on an active trip, which can be a lifeline in cases of serious injury.

Common Causes and Potential Compensation

While rideshare services may have helped reduce DUI incidents, a study on traffic deaths links them to a 3% increase in car accident fatalities, a sobering reminder of the risks involved.

Common Causes of a Rideshare Car Accident

In South Florida, from Miami to Boca Raton, several patterns of driver negligence cause rideshare accidents. The pressure to complete trips quickly can lead to speeding, running red lights, or making unsafe lane changes. Other common causes include:

- App Distraction: Drivers are constantly interacting with their phones for navigation and ride requests, taking their eyes off the road.

- Driver Fatigue: Long, irregular hours can lead to slower reaction times and poor judgment.

- Unfamiliarity with Local Roads: Navigating new areas can lead to sudden, unsafe maneuvers.

- Poor Vehicle Maintenance: Issues like worn tires or failing brakes on a driver’s personal car can contribute to a crash.

Of course, other negligent drivers or road hazards can also cause a rideshare car accident. Determining fault requires a careful investigation.

What Compensation Can You Recover?

If you’ve been hurt in a rideshare car accident, you may be entitled to compensation for your losses. This is intended to cover both your financial and personal costs.

- Medical Expenses: This includes all related costs, from the emergency room visit and ambulance ride to surgery, hospital stays, medications, and physical therapy.

- Future Medical Care: If your injuries require ongoing rehabilitation, future surgeries, or long-term care, these projected costs can be included in your claim.

- Lost Wages and Diminished Earning Capacity: You can be compensated for the income you’ve already missed. If your injuries permanently affect your ability to earn what you once did, you can also claim for a loss of future earning capacity. Our page on Lost Wages Lyft Car Accident explores this.

- Pain and Suffering: This compensates for the non-financial impact of your injuries, such as physical pain, emotional distress, and loss of enjoyment of life. The amount varies based on the severity and long-term effects of the injuries.

- Property Damage: This covers the cost to repair or replace your vehicle or other personal property damaged in the crash.

The amount you can recover depends on the severity of your injuries, their impact on your life, who was at fault, and the available insurance coverage.

The Role of a Rideshare Accident Lawyer

When you’re recovering from a rideshare car accident, you’re also facing a maze of insurance policies and legal deadlines. At The Barzakay Law Firm, we understand how overwhelming these cases are. Rideshare accidents involve complex insurance and liability issues not present in typical car crashes, and we can help you steer them.

We start by investigating what happened. This means gathering all evidence, including police reports, witness statements, photos, medical records, and, crucially, data from the rideshare app. This app data often determines which insurance policy applies.

Proving negligence is a critical step. We work to show that another party’s carelessness caused your injuries and damages. This is necessary to recover compensation.

Dealing with insurance companies is tricky. We handle all communications with insurers, protecting you from their tactics, which often include seeking recorded statements or pushing for a quick, low settlement. A Lawyer Uber Driver understands these specific challenges.

We also calculate your full damages. This goes beyond initial medical bills to include future medical care, lost wages, and the impact on your quality of life, such as pain and suffering.

Most cases settle before trial, but only when the insurance company offers a fair amount. We negotiate aggressively and are fully prepared to take your case to court if a fair offer is not made.

Florida’s no-fault system means you’ll file with your Personal Injury Protection (PIP) coverage first. However, PIP only covers a portion of your costs and does not cover pain and suffering. Pursuing a claim against the at-fault party is essential for full compensation.

Time is a factor. In Florida, you generally have two years from the accident date to file a personal injury claim. Missing this deadline means you lose your right to seek compensation. We encourage anyone injured in a rideshare car accident in Hollywood, Miami, or anywhere in South Florida to contact us soon after the incident to protect their rights.

Frequently Asked Questions about Rideshare Accidents

What if the other driver, not the rideshare driver, was at fault?

If another driver caused the crash, their personal auto insurance is the primary source for compensation. If that driver is uninsured or has insufficient insurance to cover your losses, the rideshare company’s uninsured/underinsured motorist (UM/UIM) coverage may apply. This is especially true if you were on an active trip (Periods 2 or 3). Proving the other driver’s fault is essential in these situations.

Can I sue the rideshare company directly?

This is challenging because Uber and Lyft classify their drivers as independent contractors, which often shields the companies from direct liability for a driver’s negligence. However, a lawsuit against the company itself may be possible in specific circumstances, such as negligent hiring or retention. This could apply if the company failed to conduct a proper background check or ignored a driver’s dangerous record. Pursuing a direct claim may also be an option if your damages exceed the available insurance policy limits. Our firm understands the nuances of these claims across South Florida. For more information, you can read about Suing Lyft for Car Accident.

How long do I have to file a claim in Florida?

In Florida, the statute of limitations for a personal injury lawsuit is generally two years from the date of the accident. This is a strict deadline. If you miss it, you typically lose your right to seek compensation through the courts, regardless of your injuries. Building a strong rideshare car accident case takes time—from gathering evidence to negotiating with insurance companies. Acting quickly is important to preserve evidence and protect your legal rights. That’s why it’s wise to contact The Barzakay Law Firm as soon as possible. We can handle the legal complexities while you focus on your recovery.

How We Can Help You Steer Your Claim

If you’re hurt in a rideshare car accident, you’re likely facing physical pain, mounting bills, and confusing questions from insurance companies. It can feel overwhelming.

At The Barzakay Law Firm, we help people across South Florida—from Miami to Hollywood and Boca Raton—steer these unique challenges. Rideshare car accident cases are complex, with shifting insurance coverage and large corporations protecting their own interests. We handle the legal work so you can focus on getting better.

We investigate the crash, gather evidence, deal with insurers, and fight for fair compensation for your medical bills, lost wages, and pain and suffering.

Importantly, we work on a contingency fee basis. This means you pay no legal fees unless we win your case. You shouldn’t have to worry about affording a lawyer while you’re recovering.

We know the roads in South Florida and understand the challenges of accidents in busy areas like Sunrise and Orlando. This local knowledge helps us build strong cases and pursue the compensation you deserve.

You don’t have to face this alone. Let us handle the legal maze while you focus on healing. If you’ve been injured in a rideshare accident in Hollywood or anywhere else in South Florida, we’re here to help. Get help with your rideshare accident in Hollywood.

Contact us today for a free consultation. We’ll listen to your story and help you understand your options with no obligation.